Raise taxes, make cuts, use funds from the city’s rainy day fund or any combination thereof.

Those were the choices laid before Asheville City Council during an April 9 budget work session after members learned that a 4.11% pay raise for city employees next fiscal year would drive the city’s undesignated general fund balance below its preferred minimum.

According to Just Economics of Western North Carolina, a single person working full time in Buncombe County needs to make $22.10 per hour to afford basic expenses in 2024. Some city employees make less than that.

During the work session, city Finance Director Tony McDowell explained that city staff recommends a 4.11% raise for all city employees for the upcoming budget cycle, which would bring the lowest-paid employees from $37,960 to $39,520 per year. That pay rate falls in line with Just Economics’ living wage pledge, a tiered certification that allows employers to remain in the Living Wage Program if they agree to pay a $19 per hour rate while committing to annual increases toward the new $22.10 rate.

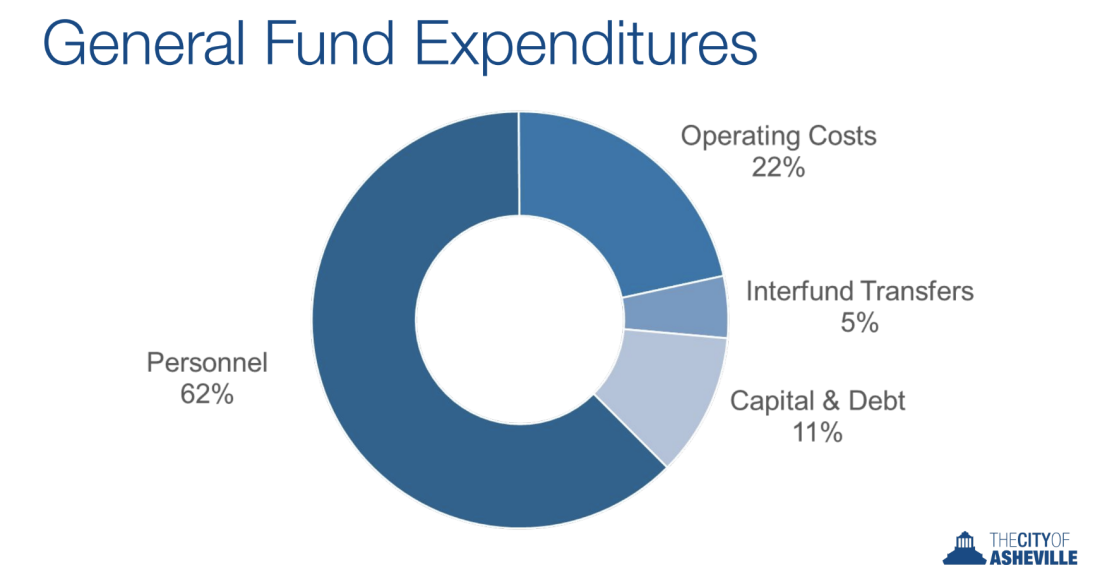

Employee compensation makes up 62% of the city’s general fund budget. City Manager Debra Campbell said that the pay raises were crucial for the city to continue recruiting and retaining staff across all departments.

Council also reviewed other types of pay increases, including flat rate payments for all city employees regardless of position, and a hefty 21% raise for all employees to meet this year’s full living wage, but McDowell pointed out that those options were either too costly or caused compression issues, which occurs when there’s little difference in pay between employees, regardless of differences in their respective responsibilities, knowledge or experience.

City staff also recommended increases to city employees’ health benefits by $2.1 million, of which roughly $775,000 would come from the city’s general fund.

Raising salaries by 4.11% and covering the increasing cost of employee health care amount to $4.6 million. Those costs and other expenses would pull a total of $8.1 million from the city’s general fund.

That level of spending, said McDowell, would put the city’s undesignated fund balance below its desired 15% of the fund’s total budget. Essentially, the general fund is the city’s checkbook, which is primarily funded by property taxes and fees. Other money, such as from specific project funding, grants or debt, is kept in different accounts.

Asheville has maintained the 15% undesignated fund balance policy for the last several years to cover unforeseen revenue fluctuations and unanticipated expenditures. The N.C. Local Government Commission recommends that municipalities maintain at least 8% of the adopted general fund budget as undesignated funds, but there is no state minimum requirement.

“Hopefully, after we make decisions around compensation, the fund balance might come in around 13% or 14%,” said McDowell.

Dipping into the city’s undesignated fund balance drew concern from several members of Council.

“That gets me a little bit worried because one of the rules is don’t use your fund balance for recurring expenses because you essentially cannot count on that [next year],” said Mayor Esther Manheimer. “That makes me concerned about overall sustainability.”

“I mean, I’m not sure what the solution is, because I’m just getting these numbers. But I’m concerned that we are dipping into fund balance for payroll,” added Council member Sage Turner.

“Say we do it,” Council member Maggie Ullman posed. “What do we do next year?”

One tool that Council could use to pay for the raises is a property tax increase. That idea was also unpopular among Council members, though some acknowledged that they had few options.

Campbell said that she and city staffers were not recommending a tax increase on top of the recently approved increases for city fees and charges; a $150 million in general obligation bonds proposal that would impact taxpayers over the next four years; and the possibility of a business improvement district that would tax property owners located in downtown Asheville.

One factor that might help is the fact that Buncombe County will be reappraising all properties in the county in 2025 to update property taxes. Manheimer pointed out that the likely property value increase will generate more revenue for the city without having to raise the tax rate.

“We believe, to maintain employee morale, to retain the employees that we have, we have got to provide a salary increase. Obviously, it’s not as much as we would like. It’s not as much as we did last year, but it’s what we think we can afford with the use of fund balance,” Campbell maintained. “And no, it isn’t best practice. But it’s all we got.”

The Tuesday work session was the last of five sessions and other budget-related meetings since Council began its budget process in December. Campbell will present the proposed budget to Council at its meeting Tuesday, May 14. A public hearing on the budget is slated for Tuesday, May 28, with budget adoption scheduled for Tuesday, June 11.