Damaged homes, canceled bookings and visitor hesitancy has shaken the once-roaring short-term rental (STR) market in Asheville and throughout Western North Carolina since Tropical Storm Helene ravaged the area in late September.

Tyler Coon, CEO and founder of Savvy Realty, which focuses exclusively on short-term rentals for both buyers and sellers, remembers watching the slow but meaningful impact on the local STR inventory in the weeks and months following the storm.

“There was a massive decline in the number of [active short-term rental] listings. In October, I remember thinking, ‘OK, we lost like, 3% or 4% [of active listings]. By November, I think it climbed to 7%,” recalls Coon. “It was really December and January where we started realizing that this is going to have a much larger effect than we really thought.”

Recent data from AirDNA, a research and analytics platform that studies the short-term rental market, indicate that more than 1,400 STR units have left the WNC market in the months that followed the storm — a reduction of 21% of active STR listings in 2025 compared with 2024. The numbers represent the largest contraction of the local STR market since short-term rentals began soaring in popularity more than a decade ago.

But the news isn’t all bad, according to some area STR experts. In fact, the upheaval may offer unexpected benefits for STR hosts and WNC residents, while providing a better visitor experience.

A new kind of crisis

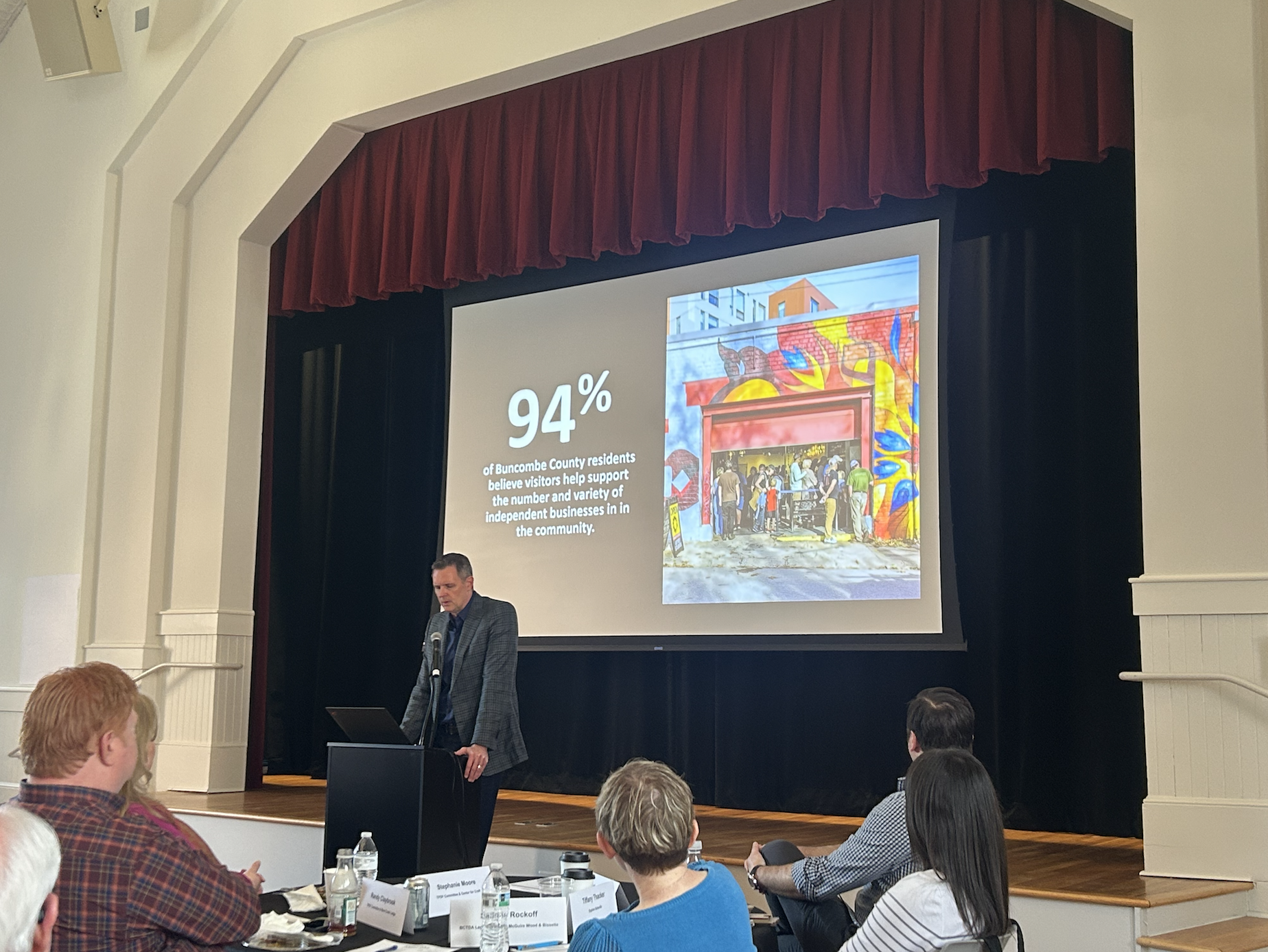

Demand for short-term rentals has outpaced hotels for years in Asheville. An Aug. 28 Buncombe County Tourism Development Authority (BCTDA) report noted that from 2019-24, hotel demand in Buncombe County grew 5%, while vacation rental demand grew 57% over the same period.

The COVID-19 pandemic fueled that growth as cautious visitors sought the safety of private rentals over hotels and motels, says Mark Bastin, chief marketing officer at Yonder Luxury Vacation Rentals, which manages roughly 230 short-term rentals across 14 counties in Western North Carolina.

“Short-term rentals saw a real jump in popularity during that time for a lot of obvious reasons,” says Bastin. “A lot of folks didn’t want to go to hotels. They didn’t want to get on cruise ships. They didn’t want to get on planes. Vacation rentals were sort of the perfect solution because you could isolate and you didn’t have to worry about COVID.”

But if COVID was a boon for the local STR market, Helene had the opposite effect. After the storm, emergency responders and displaced residents flocked to hotels and motels. Vic Isley, president and CEO for Explore Asheville, said during a Jan. 29 BCTDA meeting that hotel stays increased 6% in December compared with December 2023, while vacation rentals dropped 23% during the same period.

Bastin says the decreases in occupancy could be attributed to several factors, including home damage or accessibility issues due to landslides or closed roads. While the majority of properties he helps manage fared well during the storm, Asheville’s extended water and electricity outages drove many would-be renters away during the busiest time of year for visitors. Many hotels brought in their own water supplies during that period.

“Typically a fall season, which is our peak season, we’re seeing anywhere between 65%-70% occupancy. In October, there’s a huge demand,” he explains, noting that Yonder’s listings typically maintain higher nightly rates than other STRs in the area. “Obviously, we, along with a lot of other property managers, saw a huge drop in occupancy from the storm. I would say paid occupancy was probably hovering in October anywhere from 25%-35%, so it was a deep, deep drop from what we’re normally accustomed to.”

Bastin specifies “paid occupancy” because some STRs were occupied by owners or were housing displaced families and utility workers at steep discounts or for no cost, depending on the homeowner.

Effect on housing supply

While the boost from COVID-19 expanded STR listings in the area, the impact of Helene has caused some STR investors to think twice about their business model, says Coon.

“The growth of short-term rentals has sort of plateaued — if not dropped — certainly from last year. I don’t think it’s going to see any big increase in folks coming in and going, ‘Gosh, I want to do the short-term rental thing,’ like they did during COVID, because they saw it as a great investment,” says Coon.

But, Coon emphasizes that the type of STR listings that fell off the books is important. He says that the most in-demand STRs are higher-end, large homes, often with amenities like hot tubs or pickleball courts. Meanwhile, smaller homes with few or no amenities have tended to be the ones dropping out of the STR market. The net effect, Coon says, could mean more affordable housing is available for low- to middle-income families who are looking to purchase or rent.

“They’re the $300,000 to $500,000 houses that somebody bought up and put some Amazon furniture in and didn’t do a whole lot to it,” he says. “And so despite obviously massive devastation from Helene — I don’t ever want anyone to think that I’m trying to shine a positive light on it, but despite that — I think that these are the type of houses that Asheville needed to go back to the market.”

Coon notes that the reduction in STR inventory is also good for the short-term rental market by reducing competition among hosts, especially in the slower months.

That means occupancy rates are holding steady even after the storm because the number of STRs dropped.

“I think ultimately what we’re seeing is kind of a consolidation, which I think is good for the industry. When you get a saturation, that’s when you start getting complaints from the locals. There’s too many homes sitting there empty,” he says. “If you look at occupancy in February, for instance, in 2025 it was 42.2%, and in 2024 it was 41.7%. I think the reason that’s happening is because there’s fewer listings competing for bookings.”

No new STR regulations, for now

In short, the storm might have solved, if only temporarily, an issue the county has been wrestling with for years: how to regulate the STR industry. Opponents of STRs have long blamed STRs for contributing to Asheville’s housing crisis and negatively affecting neighborhoods. A consulting firm hired by Buncombe County identified 5,268 STRs within the county as of 2022, representing roughly 4.5% of the county’s housing stock.

While the City of Asheville implemented restrictions in 2015 that banned whole-house rentals (violators facing a $500-per-day fine), Buncombe County has had few STR regulations. County STR operators have the option to rent out entire homes and are not required to live on the property or even within the state, though hosts are required to apply for a one-time permit.

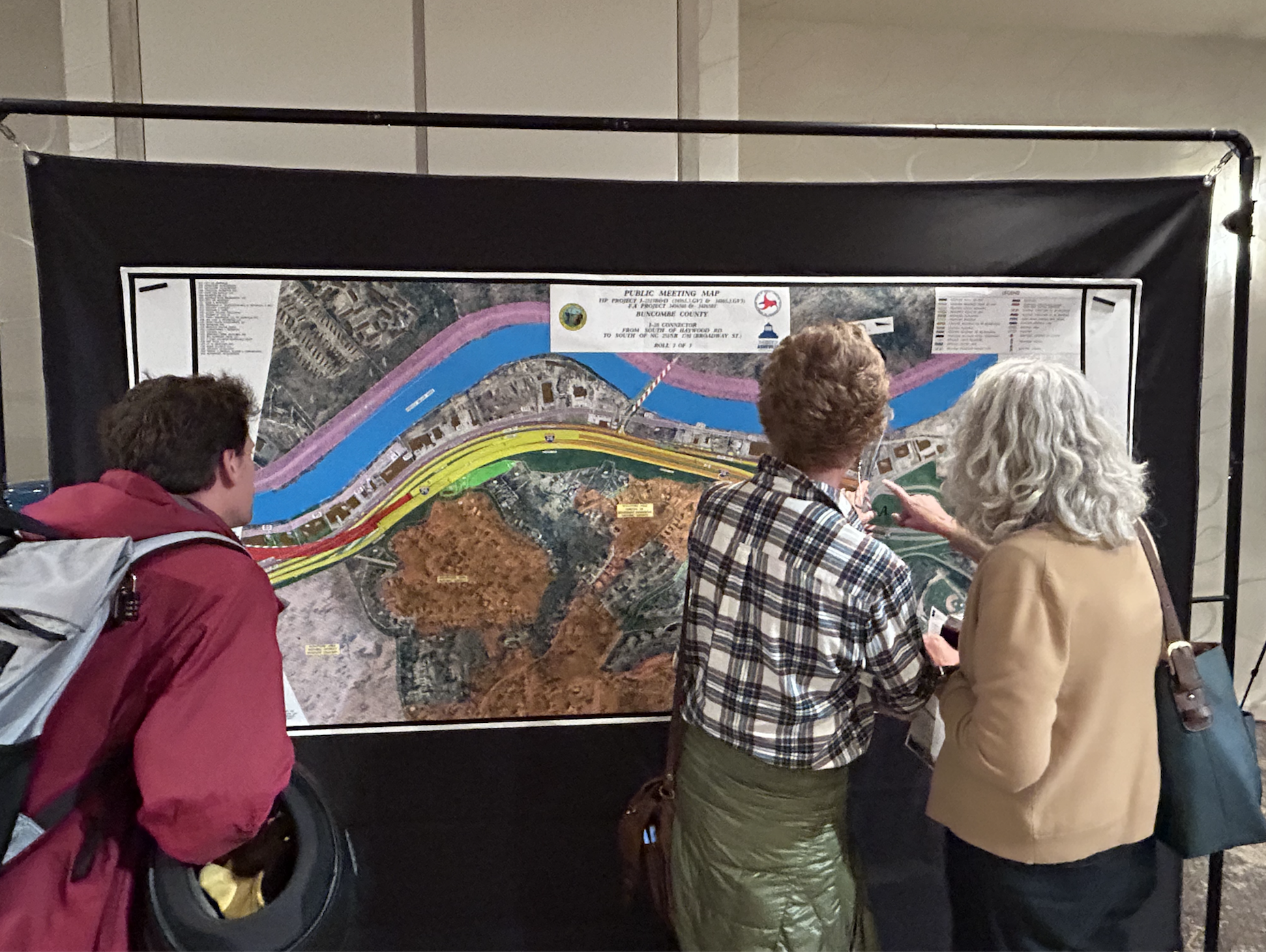

That was poised to change last year, when the Buncombe County Planning Board took up the thorny issue by recommending rules aimed at reducing the number of STRs. After a series of contentious public meetings, a 100-day pause and no consensus in sight, the Buncombe County Board of Commissioners voted to create an 11-member committee tasked with finding agreement among all the parties.

The group, known as the Ad Hoc Short-Term Rental Committee, was expected to make its recommendations to the Planning Board in November, but those plans fell apart after Helene. County Planning Director Nathan Pennington tells Xpress that rather than revisit the issue, the county is focusing its efforts on the more pressing matter of Helene recovery.

“The short-term rental landscape has changed dramatically. Many short-term rentals took advantage of the opportunity to convert to long-term rental options post-Helene,” says Pennington. “The Planning Board will be working on the Swannanoa Small Area Plan and other text amendments that support long-term recovery and economic development, including ways to reduce housing barriers and changing the way we review projects.”

Bastin says he wasn’t expecting the issue to be dropped, but it makes sense given the extent of the damage in the area. Still though, he found the work that the ad hoc committee was doing to be beneficial for both STR operators and the community at-large.

“Our feeling was that the task force was important and that it was a way for us to work with county officials to draft what we believe would make better sense STR regulations. Collaboration is what we had always wanted,” he explains.

Coon notes that the pause might give the county time to refine its one-size-fits-all approach.

‘Trifecta of conditions’

While Asheville and Western North Carolina continue to recover from Helene, Bastin says the local STR market still faces headwinds.

“We’re still seeing the ripple effects of what happened in Helene. I think that what you have now, especially since the storm, is almost a trifecta of conditions,” he points out.

National coverage of the storm and its aftermath has altered visitor perceptions about the area, leading some to wonder whether Asheville is safe to visit or if businesses, restaurants or hiking trails remain closed. Explore Asheville, the BCTDA’s marketing arm, and other tourism and small-business entities are diligently battling those sentiments. “While there are still some places you’ve got to be sensitive to, there is a lot that is open, and that’s a message that we’re pushing out hard,” Bastin says.

He also points out that the industry is experiencing a quieter-than-normal slow season. This January through March felt even more painful for hosts who typically rely on the peak season to get them through the quieter times.

“October, November and the holidays give us a little bit of a buffer for the slow months. We just didn’t see that this year,” Bastin says.

The third, and perhaps, most difficult to control element impacting local STR bookings is national and global economic uncertainty. Tariffs, stock market fluctuations and fears of a potential economic recession may have visitors thinking twice about spending on travel and dining out.

“It’s almost this perfect storm of conditions that has been keeping us slower than usual,” says Bastin.

Despite those challenges, both Bastin and Coon have a positive outlook on short-term rentals and the community at large as the market adjusts to the post-Helene landscape.

“I do hope that some of the short-term rentals that would be considered affordable housing, that more of that stock can continue to return to primary homes,” says Coon. “I would love to see that. It would be good for the market and for the residents who live here.”

“It’s going to be a little bit of a long road, but I think that the initiatives that Explore Asheville is doing, their advertising and marketing, is beginning to show. I think ‘Good Morning America’ coming here was a big thing,” Bastin adds. “So, the road to recovery is not going to be fixed overnight, but we’re seeing more interest coming to the area. There’s more inquiries. We’re seeing interest in the summer. We’re seeing interest in next fall. Bookings are picking up. So we’re cautiously optimistic.”